Money is a #1 concern for new entrepreneurs and established business owners alike.

In fact, according to data from CB Insights, 29% of startups fail because they run out of cash – and some sources put the failure rate as high as 82% among both new and established businesses!

Unfortunately, many business owners throw away money without even realizing it. And when you’re working so hard to MAKE money, it’s crazy to think you’re WASTING money without even knowing it.

This post will point out the most common ways you may be wasting money, and how you can avoid these money pits in the future!

Office space and equipment

The fixed costs associated with having an office space can be enormous. Rent alone can cost $5K/month in many major cities.

Add to this costs like internet, multi-line phone systems, printers and photocopiers, etc. and the costs add up fast.

If you need an office but still want to save some cash, consider a shared office arrangement – you can often find shared, fully-furnished offices (complete with receptionist and meeting rooms) for a fraction of what you’d pay on your own.

Have employees? Consider allowing them to work from home. And if you work alone and don’t absolutely need a separate office? It’s a no-brainer. Ditching the office space will decrease overhead and in many cases even increase productivity.

As for your equipment and furniture, buy used whenever possible. Check your local Craigslist, Facebook auction groups, or used local furniture dealers. You’ll get high-quality, gently-used furniture for a fraction of what it would cost new.

Subscription or automatic payments

While subscription payments (where money is automatically deducted from your bank account or credit card) can be handy, you have to be careful you remember what you’re paying for!

Software companies often use this model, and will deduct a set amount every month or once a year. Some of the most common subscription/automatic payments you need to stay on top of include:

- Annual web hosting fees

- Annual domain name fees

- Monthly email management software fee (e.g., AWeber, MailChimp, etc.)

- Monthly or annual social media management software fees (e.g., Agorapulse, Hootsuite, etc.)

- Membership fees to local business groups (e.g., your local chamber of commerce)

- Membership fees to online mastermind or networking groups

While these types of automatic payments can make your life much easier, just make sure you regularly check your bank and credit card statements so you’re not paying for something you no longer use or need.

Traditional advertising…sometimes!

Traditional advertising (magazine ads, radio spots, other forms of print media, etc.) can be a huge money pit if you’re not careful.

While these methods can still be effective in certain situations, make sure you’re fully aware of what you’re getting into. Before going this route, ask the following questions:

- Can I see case studies from previous advertisers?

- Can I see detailed demographic info to make sure I’m targeting the right audience?

- How will we track the effectiveness of my ads?

You also need to ask yourself: can I use digital marketing or social media to reach my audience more effectively and for less money? (hint: the answer is probably YES!).

Underused social media management tools

You know I LOVE my social media tools!

But sadly, I see too many business owners paying way too much for tools that they don’t even fully utilize.

When choosing a social media management tool, make sure you understand exactly what each tool offers, and then choose the one(s) that work best for your business and your budget.

Know exactly what you’re getting before you commit to a tool!

I also recommend reviewing your tools every 6 months to a year to ask yourself if you still need them. With many tools costing hundreds of dollars (or more!) each year, you really want to make sure you’re getting the most out of them.

Not sure which tools are the most effective and worth the $$$? Check out my post, 15 Best Social Media Management Tools.

Doing everything yourself

Most entrepreneurs are multitaskers, and aren’t afraid to get their hands dirty. Because of their limited budgets, they often end up doing it all: SEO, marketing, content writing, customer service…you name it!

And while this can seem like it’s saving you a lot of money, it may end up actually costing you in the long run.

For instance, many business owners tackle their own SEO. It takes them hours each week, and may take many months or even years for their efforts to start paying off; and sometimes it never pays off.

In this case, hiring someone who has the skills and expertise to get your site ranking quickly may be a better investment, and may result in a much higher (and quicker) ROI.

Outsourcing everything

On the other hand…

Sometimes business owners can be a little too quick to outsource tasks (especially non-revenue generating ones) they could easily do themselves.

I find many businesses owners (especially new ones) are quick to hire out positions like virtual assistant, content writer, salesperson, etc.. And while I definitely recommend outsourcing these roles if need be, ask yourself first: is this something I have the time and skills to do myself? If the answer is yes – and especially if money is right – it may be worth slowing down and giving it a try yourself first.

Scaling too quickly

If you’ve achieved some success with your business – and especially if you find yourself being run ragged by the demand for your product – it’s tempting to try to expand quickly. This could mean hiring more employees, expanding your facility, offering more products, etc.

The problem, however, is that scaling can be expensive; and once you expand, it can be difficult to scale back, especially when your employees’ livelihoods are on the line.

If you do want to scale your business, make extra sure you do it slowly and intentionally. Have a plan in place, and make sure the market (and your wallet) is ready for the growth.

Graphic design

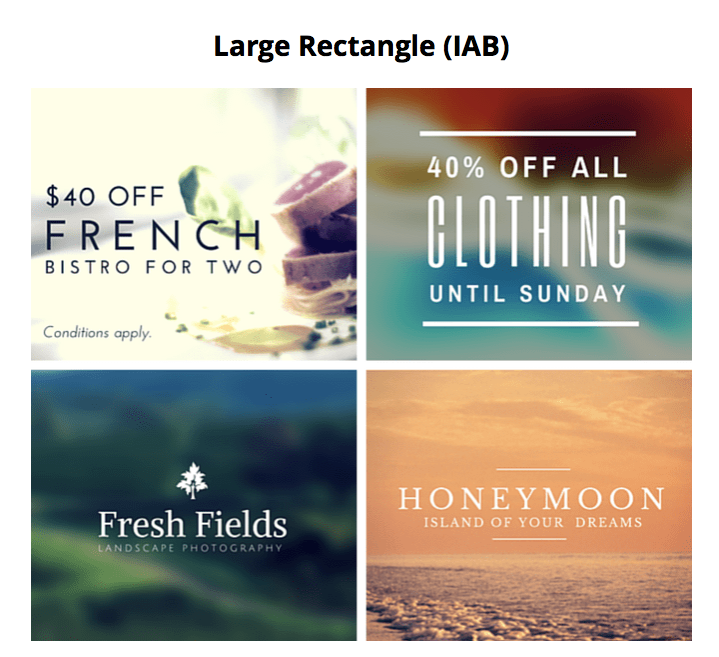

With so many amazing free and low-cost graphic design tools out there, there’s no reason to pay a graphic designer for every single ad, header or social media image.

Tools like Canva and Snappa are both great (cheap or even free) choices that anyone can use to easily create almost any type of graphic.

You can create stunning graphics for cheap or free using a tool like Canva

And if you don’t want to go the DIY route? Using a low-cost service like Design Pickle lets you receive unlimited design help at a low monthly fee.

Ineffective paid online advertising

Facebook ads, Google AdWords and paid social media posts can be highly effective, but only if you go in with a plan.

Unfortunately, it’s way too easy to just keep your campaigns running (and keep throwing money at them), even if you don’t know whether they’re working or not.

The best way to protect yourself against this money pit is to educate yourself before you jump in, and then carefully track the results of your ads. These posts and guides will help!

Get Amazing Results With Facebook Ads With $10 A Day

The Ultimate Facebook Ad Building Guide [Free Download]

How To Split Test Facebook Ads To Get Real Results

Credit card debit

Business credit cards can be great tools for managing your cash flow during the month. Unfortunately, if you’re not careful they can become a huge liability.

There are two types of business credit card users: transactors and revolvers. Transactors use their credit card as an easy way to make monthly purchases while also building up points or other rewards – and they pay off their balance each month before interest is accrued.

Revolvers, on the other hand, maintain a balance month after month, regularly paying high interest.

In case it’s not obvious – be a transactor, not a revolver! With average credit card interest rates running between 16-20%, this is definitely not a debt you want to hold onto for very long!

Unnecessary phone and internet charges

Whether you work from home or rent an office space, phone and internet charges can be a huge expense every month.

Some ways to reduce these costs:

- Locking in to a two or three year plan can save you money – just be sure to check out how much it will cost should you need to break your contract.

- Check your monthly internet usage to make sure you’re actually on the right plan. You may be surprised to discover you can actually downgrade your plan.

- Call your phone or internet provider and ask if they have any deals or ways you could lower your monthly bill. You’d be surprised at how helpful they can be!

- If you currently use a dedicated landline for your office, consider ditching it and just use your cell phone instead.

- Do a bill audit: You’d be amazed at some of the charges that get slipped in over the years! Go over your bill and make sure you understand exactly what you’re getting charged for.

Underperforming employees or contract workers

This is a tough one. No one wants to be the bad guy by letting someone go. But an employee who doesn’t pull his or her weight could be costing you A LOT of money!

In fact, the US Department of Labor estimates that the cost of a bad hire is around 30% of that individual’s first year of earnings – and that’s just for NEW employees.

One way to make sure you’re getting the biggest bang for your buck (and finding the BEST help) is to hire freelancers. This opens up a whole new world of options: you can hire someone located anywhere in the world, you avoid paying costly benefits, and if business slows down, you don’t need to worry about firing someone who depends on you as their sole source of income.

Final thoughts

As a business owner, you can’t afford to be throwing away money. To avoid this, regularly check your monthly bills and charges, and ask yourself: “Is this service/tool/product really worth it to me and my business?”. And if the answer is no….you know what to do!

What are some money pits you’ve struggled with? Any on the list above you’re going to start avoiding? Share below!

About Author

Kim Garst

Kim Garst is a renowned marketing strategist and speaker who is trailblazing the use of artificial intelligence in digital marketing. With over 30 years of experience as an online entrepreneur, Kim helps entrepreneurs grow their business and authority online by using AI technology. She is leading the way with proven AI frameworks that help entrepreneurs build authority in their space.

She is keynote speaker and an international best-selling author of Will The Real You Please Stand Up, Show Up, Be Authentic and Prosper in Social Media.

Named by Forbes as a Top 10 Social Media Power Influencer, Kim is well-known for her skill to simplify complex technology and make the use of AI understandable for business growth. Her relatable, actionable advice helps guide new entrepreneurs to harness the power of AI to succeed in digital marketing. Kim is leading the way in combining human and technological skills to create a new model for AI-powered marketing.

Nowadays the major problem is internet and phone bills are extremely high. In fact, sometimes they cost more than any other cost. In your article, you said that instead of doing all the work you just need to hire someone, but sometimes it affects badly. I like that you give the information about the how to become transactors instead of a revolver.

Pretty good article

Such an amazing article. It adds lots of values.